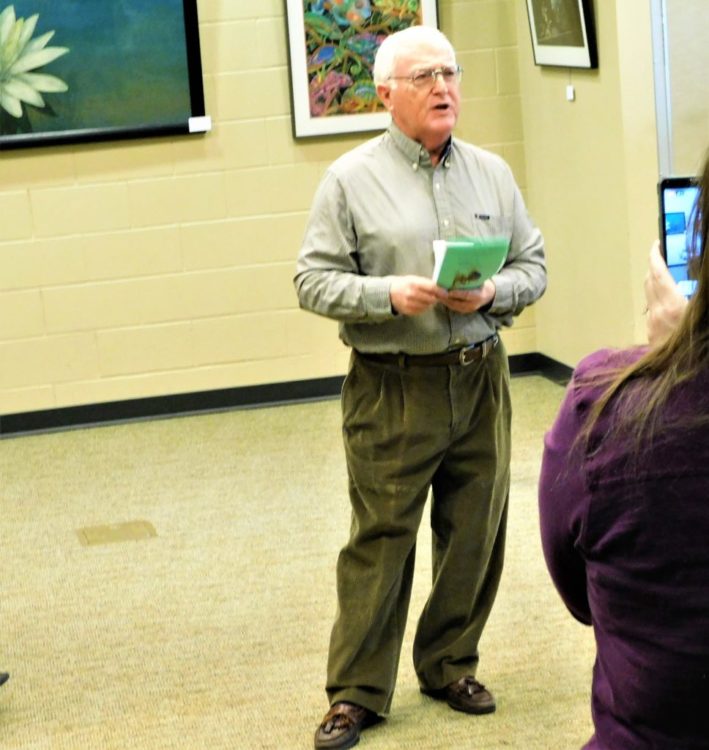

Mike Reith, 54, is the recently hired Uniontown Junior/High School Principal.

His official start date is August 1, 2019.

Reith has 32 years experience teaching math. He taught four years at Indian Trail Junior High in Olathe; 28 years at McPherson High School – upper-level math such as AP Calculus, College Algebra and was math department chair at MHS for the past 15 years.

“Uniontown will be my first job as a building administrator,” Reith said.

Reith graduated from Girard High School in 1983, earned his Bachelor of Science Degree from Pittsburg State University in 1987, Master of Science Degree from Wichita State University in 2003 and will complete his Building Administration Licensure Degree from Emporia State University in May 2019.

Reith is a Southeast Kansas native.

“I grew up on a farm 3.5 miles southwest of Hepler, then went to school K-12 in Girard,” he said.

Reith was a student who enjoyed school.

“All throughout my K-12 school experience, I enjoyed school and also enjoyed success academically,” Reith said.” I particularly excelled in math throughout high school, and really enjoyed the challenge as I progressed through the upper-level math courses.”

Reith had a math teacher that was a great influence on him.

“I had an outstanding math teacher, Gary Starr, who influenced me greatly,” he said. “I was also a three-sport athlete in high school and desired to coach at the high school level. Partnering those facts with a substantial scholarship offer from the Pitt State education department led me to the conclusion that I should pursue a math degree with an emphasis in secondary education.”

“During my teaching career, I have truly enjoyed working with students in the classroom and working with athletes in coaching. I have coached multiple sports throughout my career, but primarily basketball and track, and have been a part of some very special moments and teams.”

“While I still enjoy teaching and coaching, I began to notice an increasingly apparent need for strong leadership at the administrative level,” Reith said. “It was something that I considered earlier in my career, but the timing just wasn’t right for a variety of reasons.”

“But, three years ago, I made the decision that it was the right time and the right situation in my life to pursue a building administration degree. I will complete the program in May and receive my building administration license.”

“I am thrilled for this opportunity at Uniontown and am very appreciative to Superintendent Bret Howard and the USD 235 BOE for their support for and confidence in me. My wife and I are excited to be back in Southeast Kansas, as this gets us closer to several of our family members.”

When asked what the best part of education was for him, he replied:

“While there are many things that come to mind, the primary one is the opportunity to have a positive, life-changing impact on students, families, and communities. I believe every young person should have the hope of a successful future, and they deserve the opportunity to experience the necessary preparation for that to become a reality. Quality education is the lifeblood of a civilized society, and it is a high calling but a tremendous privilege to be a part of it.”

“I would add that I have experienced a great working relationship with my colleagues in the math department and on the girls’ basketball staff at McPherson High School,” Reith said. “It is extremely rewarding when you get the opportunity to work with like-minded educators who love what they do and are in the profession for the right reasons.”

Some of the challenges that Reith sees for future educators:

- “Public-school funding in Kansas always seems to be at the forefront of challenging issues that face education.

- “At the basic levels of daily instruction, educators are dealing with a growing number of issues students are dealing with,” resulting from a less-than-ideal home situation. I believe we need to take opportunities to work with families in this regard, to let them know we want to partner with them to help their student be as successful as possible. It is definitely a challenge to instruct students academically when they have significant issues that cause distractions.

- “The Redesign Initiative implemented by the KSDE is now something that all schools and districts in Kansas must begin to address. I believe it is imperative for schools within districts to work as a cohesive unit so that the focus and goals are consistent and effective as a student moves through the grades and schools in the district.

- “Social media presents challenges such as cyber-bullying, academic dishonesty, distractions, etc. Educators must be as proactive as possible to deal with this for the good of our students.

- “We must not lose sight of the reason education exists. We can get bogged down and pulled in many directions; sometimes when we try to do too much, we’re not good at anything. Addressing the issues and concerns that will truly help students be more successful academically, while at the same time helping them develop good character traits, are what we should be focused on.”