USD234 Board of Education Meets April 22

Unified School District 234

424 South Main

Fort Scott, KS 66701-2697

www.usd234.org

620-223-0800 Fax 620-223-2760

DESTRY BROWN

Superintendent

BOARD OF EDUCATION REGULAR MEETING

April 22, 2025 – 7:30 A.M.

AGENDA SUMMARY WITH COMMENTARY

1.0 Call Meeting to Order David Stewart, President

2.0 Flag Salute

3.0 Approval of the Official Agenda (Action Item)

4.0 Other Business – Personnel Matters – Time ________

4.1 Enter Executive Session – Personnel Matters (Action Item)

4.2 Exit Executive Session – _______ (Time)

4.3 Approval of Personnel Report (Action Item)

5.0 Adjourn Meeting _____ (Time) David Stewart, President

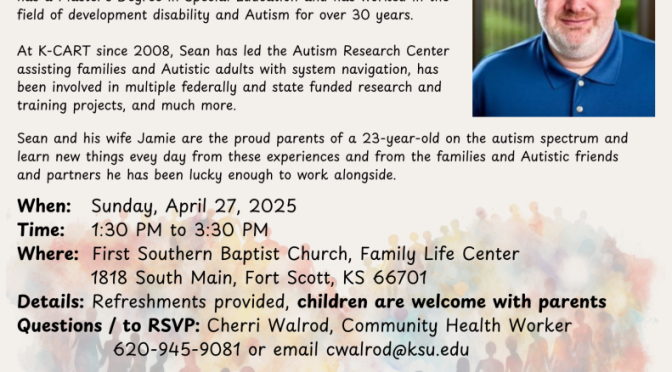

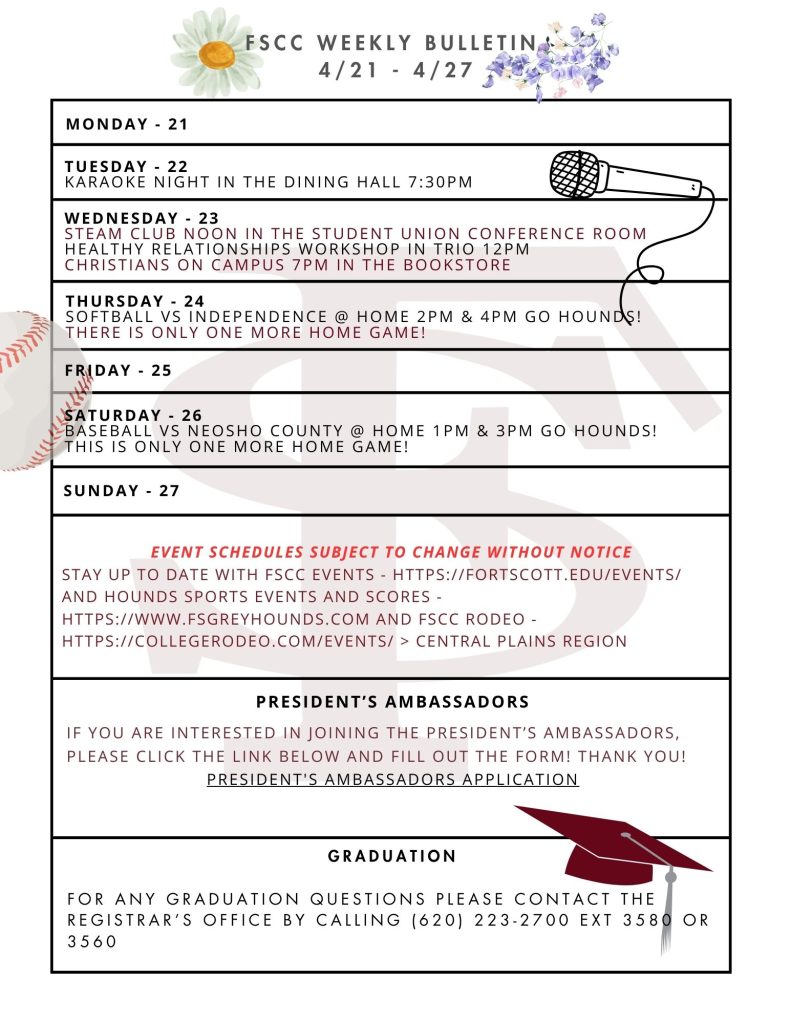

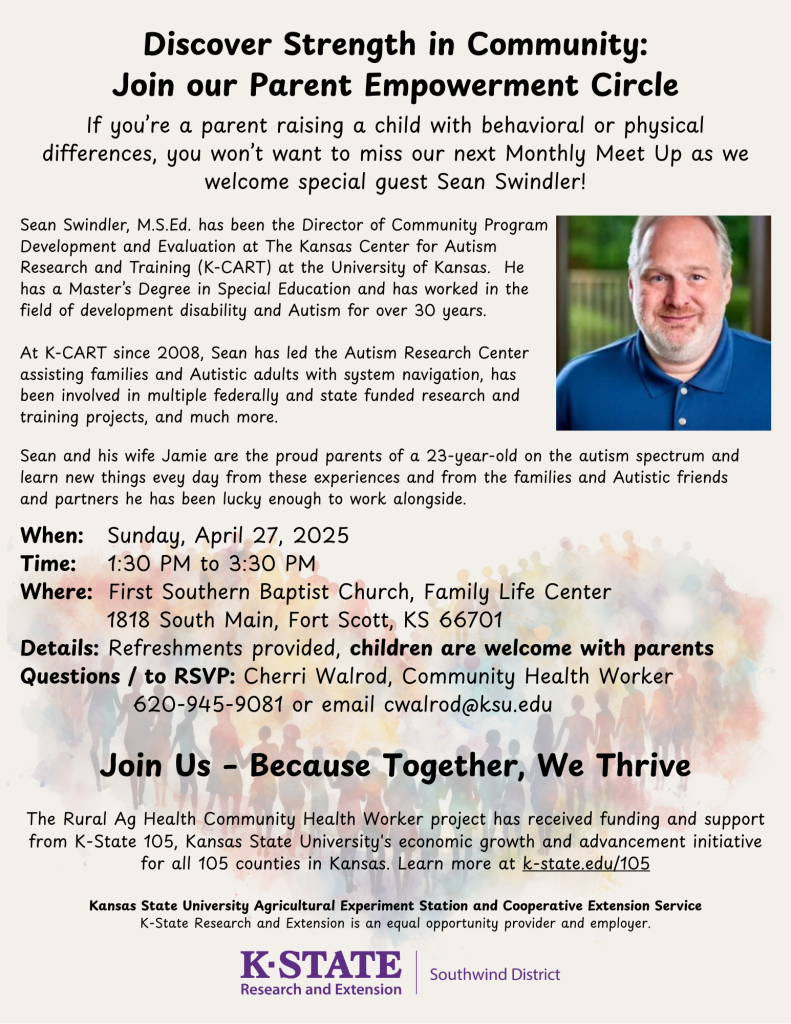

Leader of the Kansas Center For Autism Research and Training Will Speak April 27 in Fort Scott

Annual Dinner & Awards Celebration RSVP Deadline is Today

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

Opinion: Zoning, Core Principles & Rationality

In my last piece, we looked at the commission’s stated position that people who don’t want zoning have an “outdated ideology” and are “shortsighted.” (source) We looked at reasons that a person might agree with implementing zoning in Bourbon County, and also some reasons why someone might disagree. There are rational reasons for both sides. Some, if not most, of the people I know who oppose zoning do so on the grounds of core principles and a long view of the different viewpoints and quality of leadership that they expect to cycle through the commissioner seats over the coming years.

Months before George Washington was elected President for the first time, Jefferson wrote, “The natural progress of things is for liberty to yield, and government to gain ground.” He was commenting on the need for limits to the government’s power—especially in how long someone could stay President. While he agreed that the presumed President, George Washington, would make a good leader, he felt that our system of government should be designed to work well with a good President, but also work with a bad one that we may not yet anticipate. Jefferson felt that the amount of authority given to the government becomes the starting point from which it will continue to “gain ground” and the way to preserve liberty is to make sure you don’t give the government more control when you had a good leader than what you’d want if you happen to get a bad one.

Many people who oppose zoning share a similar core principle that leads them to approach any growth of government with the same concerns as Jefferson. The establishment of a framework where landowners must obtain permission from the commissioners to use their land in ways that are otherwise lawful is a long-term concern. Even if they have full faith and trust in the current commissioners, looking to the future means realizing that other commissioners will come, just as Jefferson recognized about the Presidency.

Zoning enables the county to designate specific land uses that require commissioner approval. If you have a core principle that believes that the county commissioners today and in the future are going to make these approvals in your best interest, then zoning is a great way to make sure that if your neighbor has to get permission from the commissioners in order to make sure their use is more in keeping with what you will find acceptable. (According to Johnathan Eden Commissioner Beerbower has said a shooting range would require this permission.)

On the other hand, some people have a core principle that reflects Jefferson’s concerns. Even if they would like to see their neighbors have to ask the commissioners for permission for everything the current commissioners propose today, they recognize the natural tendency of government to “gain ground” and believe that the potential inconvenience of their neighbor using their land as they see fit is a much lower risk than the cumulative ordinances that will be enacted by current and future commissioners if given the authority provided by zoning.

It is easy to see why people might rationally support zoning. It is equally easy to see why they might rationally be opposed to this. For the sake of argument, let’s assume that the current commissioners are Washington-level leaders and no one in the entire county has any concerns that they would make any decision that isn’t in the best interest of the county as a whole. Jefferson tells us the authority that we give to our government should be constrained in a way that handles the worst leadership we can imagine, along with the best. Whether you support zoning or not, you should be wary of political rhetoric that dismisses the core principles that embody Jefferson’s concerns as “outdated ideology” and labels those who hold these principles as “shortsighted.”

Mark Shead

Note: FortScott.biz publishes opinion pieces with a variety of perspectives. If you would like to share your opinion, please send a letter to [email protected].

U.S. Senator Derek Schmidt Weekly Newsletter

|

The Bourbon County Sheriff’s Office Daily Reports April 21

Famous Rolling Stone by Carolyn Tucker

Keys to the Kingdom By Carolyn Tucker

Famous Rolling Stone

I have cherished photos of my immediate family when I was 14 months old. The year was 1959 in Covina, California. Mom was wearing a hat, dress with a thin belt, a corsage, white gloves, and black patent-leather heels. Dad wore a white dress shirt, necktie, white suit jacket with a handkerchief in the breast pocket, black slacks, and black leather dress shoes. My 11-year-old brother was outfitted in a white shirt, bow tie, suit jacket, and dark slacks. I was wearing a ruffled bonnet with a matching dress, and white walking shoes. I wouldn’t part with these sentimental photos for love nor money. We were on our way to church to celebrate the resurrection of Jesus Christ, the Savior of the world!

Matthew’s account tells us how the extremely-massive stone at the door of the tomb was rolled away. “For an angel of the Lord came down from heaven, rolled aside the stone, and sat on it“ (Matthew 28:2 NLT). On this first Resurrection Sunday, the rolling-stone angel scared the living daylights out of the four Roman soldiers assigned to guard Jesus’ tomb. “His face shone like lightning, and his clothing was as white as snow. The guards shook with fear when they saw him, and they fell into a dead faint“ (Matthew 28:3-4 NLT). The soldiers were so terrified at the immense size, power, and brilliance of this angel that they fell to the ground, violently trembling and so paralyzed with fear that they couldn’t move! When they somewhat revived, they got up and ran away like little girls. The Bible doesn’t say that they screamed…but I wonder.

“After the Sabbath, as the first day of the week was dawning, Mary Magdalene and the other Mary went to view the tomb“ (Matthew 28:1 CSB). According to Luke 24:10, there were also other women with the two Mary’s. When the women came to the tomb (which had been officially sealed shut by Roman soldiers), they found that the enormous stone had been rolled away! A massive earthquake had occurred simultaneously at the moment of Jesus’ resurrection sometime before the women arrived at the garden. Just as the earth shook when the Son of God died on the cross, now the earth had exploded with jubilation at the resurrection of Jesus!

“The angel told the women, ‘Don’t be afraid, because I know you are looking for Jesus who was crucified. He is not here. For He has risen, just as He said. Come and see the place where He lay. Then go quickly and tell His disciples, ‘He has risen from the dead and indeed He is going ahead of you to Galilee; you will see Him there.’” (Matthew 28:5-7 CSB). These brave ladies were instructed to “go and see” and then “go and tell.”

When it comes to telling a story, it’s been said that women describe all the details and men just basically tell the headlines. Maybe that’s why the angel told women, and not men, to look inside the tomb and then “go and tell” what they saw. Even though they were perplexed and astonished, they obeyed the angel’s instructions.

I guess we can say that Jesus was the inventor of “show and tell.” A few days after Resurrection Sunday, Jesus appeared to His disciples a second time. (The first time, Thomas was absent so he didn’t believe that Jesus was alive.) The risen Savior spoke directly to Thomas and said, “Put your finger here, and look at My hands. Put your hand into the wound in My side. Don’t be faithless any longer. Believe!“ (John 20:27 NLT). Christ followers cannot be faithless and do the Kingdom of God any real good.

The Key: The most-famous rolling stone is the one that couldn’t keep Jesus entombed.

More Parking Space Downtown Is On the Horizon

Fort Scott Public Works personnel were excavating the site at National Avenue and First Street on Wednesday in preparation for a new public parking lot, according to Brad Matkin, Fort Scott City Manager.

Opinion: Zoning, “outdated ideology,” and “shortsighted” people

On April 7th, the Bourbon County Commissioners discussed zoning. Commissioner Beerbower read some prepared remarks and said, “Let me reiterate, it is not a matter of if we will zone. It is a matter of what zoning will look like.” (source) He further addressed people who don’t want zoning in the county, saying, “Those that hold on to the outdated ideology that zoning somehow robs their freedom and right to do whatever on their land are shortsighted.” (source)

I can definitely see some reasons zoning might be valuable as well as some reasons it might not. But let’s take an imaginary person named Fred who fits Commissioner Beerbower’s description. Fred believes that if zoning is implemented, it will place some type of limits on what he can do with his land. Commissioner Beerbower calls Fred’s belief an “outdated ideology.” But is it? If we were to enumerate all the things Fred might possibly do with his land without zoning, and then do the same thing with everything he might do with his land after zoning, are those two lists the same? If they are, then zoning does nothing.

If they aren’t the same, then zoning does remove some of the freedoms of what he can do to his land versus what he could do with it before. Now, that might not matter to Fred. If Fred wants to put a shooting range on his property, he’d need to get permission from the county commissioners. If Fred’s neighbors decide they want to prevent Fred from doing this, it isn’t a matter of working with their neighbor to create a compromise. They can now go to the commissioners and try to convince them to stop Fred. Now, whether you see that is a good or bad thing probably depends on whether you are Fred or the neighbor trying to determine what Fred is allowed to do.

(Note: The shooting range example comes from Mr. Eden’s comment about a conversation with Commissioner Beerbower.)

Commissioner Beerbower may call Fred’s view “outdated ideology,” but there are definitely some things that Fred can do without zoning that he cannot do with zoning. That’s kind of the point of zoning.

Now try to see Beerbower’s statement about zoning not taking away anyone’s freedom from his point of view. He might think he would never deny Fred’s request and it is just a matter of making sure it is safe. So from that perspective, Fred can still do what he wants with his land, it is just a matter of the commissioners making sure he does it in a way that makes his neighbors happy. So maybe the neighbors say they would be fine with the shooting range as long as it had a berm of a particular height. Fred may say, “Sure, we were going to do 6 feet, but if you feel more comfortable with 7, I can do that.” Everyone works together. Everyone is happy.

But what if everyone isn’t going to be happy? Maybe what would make Fred’s neighbors happy isn’t something Fred wants or can do. Well then it becomes a matter for the commissioners to tell Fred what he can or can’t do.

This isn’t necessarily good or bad, but it introduces a step in the way that Fred uses his land that wasn’t there before. Without zoning, Fred is the one who decides whether he wants to put in a shooting range. Zoning would give the commissioners the authority to say yes, no, or ask for changes.

When it comes to me personally, Commissioner Beerbower is right that zoning isn’t going to “rob [my] freedom and right to do whatever on [my] land.” But that is because I have no intention of doing anything on my property that anyone is going to want to control with zoning. Other people who actually make a living off their land are much more likely to want to do something with their land that would require commissioner approval. Zoning requires you to take on the burden of getting permission for things that are otherwise legal uses of your property, but it also gives you a greater say in what your neighbor is allowed to do with their property. If you think the commissioners are going to endorse the plans you want on your land, but oppose the ones you don’t want on your neighbor’s, then maybe you’ll retain your “freedom and right to do whatever on your land” for anything you might want to do and the extra step of getting permission will be just a formality. Once again, this isn’t necessarily good or bad, it is just a tradeoff.

It makes perfect sense why some people might support making this tradeoff and some people might be against it. It isn’t an irrational position to think that the current laws are sufficient, nor is it an irrational position for someone to be willing to take on more oversight in what they are allowed to do if it means they can have a greater voice in what their neighbor is allowed to do.

A lot of how people weigh the tradeoffs has to do with core principles, what someone thinks they might want to do with their property in the future, and how much they trust current and future commissioners. Since those three things vary wildly between individuals, we should expect to see people on both sides of the fence when it comes to zoning. We’ll look at some of those issues in the future, but if someone has a position different than yours, it might not be because of an “outdated ideology” and being “short-sighted.”

Mark Shead

Note: FortScott.biz publishes opinion pieces with a variety of perspectives. If you would like to share your opinion, please send a letter to [email protected].

Ad: Revival at Mt. Orum Baptist Church – April 25-27

Revival at Mt. Orum Baptist Church

Address: 1056 115th Street, Redfield, KS

Information: 620-365-9831

Hope by Patty LaRoche

Hope.

What we cling to when we stand before a fresh grave, when we are challenged to be a caregiver for a loved one, when our bipolar, adult child refuses to take her meds, when the judge hopefully will give a second chance, when the downsizing causes us our job. From where do we find our Hope?

From the Resurrection of Jesus Christ, the reason for the Easter season. I hope your Hope, like mine, comes from the knowledge that in the future (many believe sooner than later), we will find ourselves meeting Jesus, the Lamb of God, either in the air or in Heaven.

And yes, in times of despair, it’s easy to cry out, “Come, Jesus, come,” but Scripture lets us know that God is patient, waiting for more to meet His son. The best news is that Hope has a way of reshaping despair, turning it into anticipation rather than defeat because the time will come when God makes things right, all the bad will be replaced with good, and, best of all, we will be like Jesus. Hallelujah!

Because of Hope, we can put all our eggs in one basket: a day of restoration and renewal is ahead, a day that speaks to our deep longing for something better. Jesus will be the one who meets his people as they cross from death to life. The crippled will run marathons, the blind will see color and form, the hungry will feast on all-you-can-eat buffets, the paralyzed will dance and the mentally deficient will sit around the Heavenly campfire, conversing with the Creator of the universe.

I love Easter, not for the egg hunts but because of the resurrection of Jesus Christ, a truth that, according to Matthew, Mark, Luke and John, is echoed by well over five hundred witnesses —beginning with Mary at Jesus’ tomb and ending with the apostle Paul—who saw the risen Christ at various times and places. It’s no wonder the Christian Church exploded during that first century. They had seen Truth, and from that, their Hope was alive.

Our religion hinges on that one event. If the Resurrection never happened, then our faith is useless. If Christ is not risen, then Christianity is just a myth. We can live any way we want, act any way we want, do anything we want, say anything we want, and it doesn’t matter at all. But because Jesus has been raised, it matters…if we too want to rise!

Jesus’ best friend, John, wrote of our Savior’s promise: “I am the resurrection and the life; he who believes in Me will live even if he dies” (John 11:25 NIV). That was true in Jesus’ day, and it’s true today.

Put all your eggs in that basket. It’s the only one that matters.

Author: A Little Faith Lift…Finding Joy Beyond Rejection

www.alittlefaithlift.com

AWSA (Advanced Writers & Speakers Assoc.)