|

Care to Share (“The Sharing Bucket”) will be hosting the 5th Annual “TaTa” Ride on June 15th, 2019 and an “AR-15 Gun Raffle”. Raffle tickets are $5 each and on sale now! ATF Regulations apply. Contact Stacey Wright for tickets or more info. (See flyer below)

|

|

2019 Spring Job Fair, hosted by the Chamber of Commerce – Employers are hiring! Full-Time & Part-Time positions are available

Tues., April 2nd, from 10am-2pm at the FSCC Ellis Fine Arts Center, 2108 S. Horton

Employers may contact the Chamber to reserve a booth at 620-223-3566.

Employment candidates should be ready, bring resumes, and dress for success

|

| 15-16 |

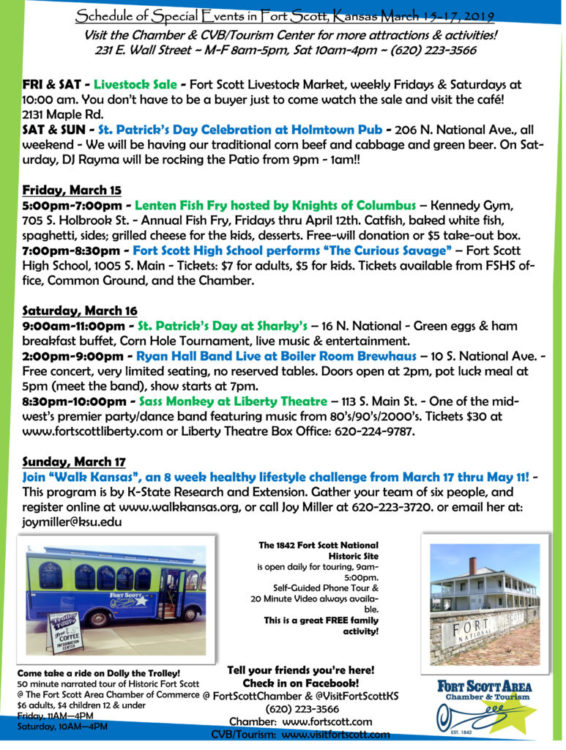

Weekly Livestock Sale at Fort Scott Livestock Market. Starting at 10am on both Fridays & Saturdays

Fridays: Cows, Pairs, Big Bulls

Saturdays: Stocker & Feeder Cattle, followed by any cows & bulls that come in late Friday & Saturday. Cafe open both sale days. You don’t have to be a buyer, just to come watch the sale and visit the cafe!

|

| 15 |

Friendship Soup Lunch hosted by First United Methodist Church has been CANCELLED for this month |

| 15 |

Lenten Fish Fry hoted by Knights of Columbus – Kennedy Gym behind Mary Queen of Angels Catholic Church, 705 S. Holbrook

Each Friday from March 8th through April 12th. Doors open at 5pm and we serve until 7pm. Menu includes southern fried catfish, baked white fish, spaghetti, green beans, coleslaw, baked potatoes and french fries, grilled cheese for the kids. Free-will donation or $5 for

take-out box |

| 15 |

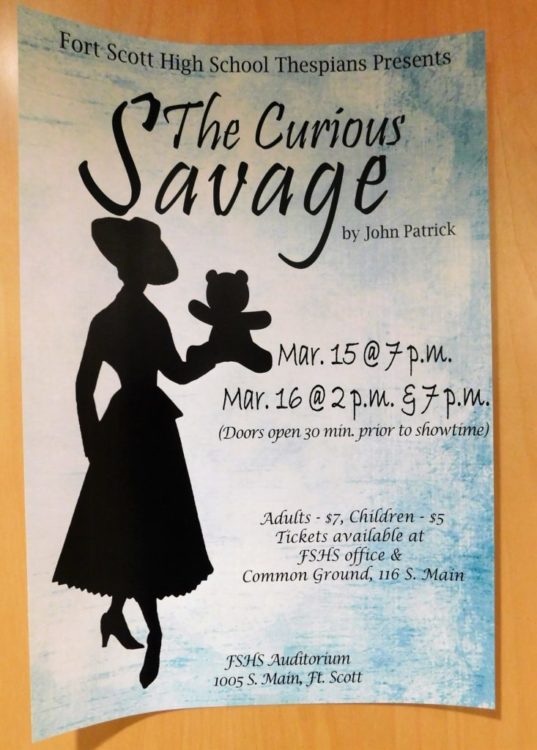

Fort Scott High School performs “The Curious Savage”, 7pm

A cast of colorful characters, a greedy chase for missing money, and a heartwarming message will intrigue audiences at this Spring play

Tickets are $7 for adults, $5 for children. Tickets are available from the high school office at 1005 S. Main, or at Common Ground, 116 S. Main, or at the door

|

| 16-17 |

St. Patrick’s Day Celebration at Holmtown Pub – 206 N. National Ave., all weekend

Holmtown Pub is ready for their big day! We’ll be serving traditional corn beef and cabbage and green beer. DJ Rayma will be rocking the patio from 9pm-1am. Wear your green and bring your favorite leprechaun! |

| 16 |

St. Patrick’s Day at Sharky’s Pub & Grub – 16 N. National, starts at 9am

– Opens with 9am green eggs & ham breakfast buffet

– Corn Hole tournament at 1pm. $25/team, cash prizes

– Danny Joe, from Danny & the Eastsiders at 2pm

– SEKB Entertainment at 7pm

|

| 16 |

The Ryan Hall Band performs live at Boiler Room Brewhaus – 10 S. Main

You will not want to miss this show! Fort Scott is privileged to have such a talented musician playing at your local brewery. This is the first time Ryan has played in Fort Scott. He and his band are sponsored, so it is a free concert and has very limited seating, with no reserved tables. Doors open at 2:00, pot luck meal at 5:00 (meet the band) show starts at 7:00

|

| 16 |

Sass Monkey performing at Liberty Theatre – 113 S. Main St., 8:30 pm

Sass Monkey is one of the mid-west’s premier party and dance bands featuring music from the 80’s, 90’s, and 2000’s. Bring your dance shoes!

Tickets are $30. Purchase online at www.fortscottliberty.com, our Facebook page, or call the Liberty Theatre Box Office:

620-224-9787 |

| 17 |

Join Walk Kansas 2019 – an 8-week healthy lifestyle challenge!

Walk Kansas 2019 – An 8-Week healthy lifestyle challenge from March 17th to May 11th! Gather your team of six people by March 15th. Register online at www.walkkansas.org or by contacting Joy Miller: 620-223-3720 / [email protected].

Earn 4 Health Quest credits towards State of Kansas health insurance for participating in the program! (See flyer below for more info)

|

| 18 |

Community Book Club – email [email protected] for location, 7-8pm

This month’s book: A Gentleman In Moscow by Amor Towles |

| 19-20 |

Story Time – Fort Scott Public Library, 201 S. National Ave., 10-11am |

| 19 |

T.O.P.S Meeting – Buck Run Community Center,

3-4pm |

| 19 |

Fort Scott Kiwanis Meeting – FSCC Heritage Room, 2108 S. Horton, 12-1pm |

| 19 |

KW Cattle Company Bull Sale – 1996 Jayhawk Rd., 12-2pm

KW Cattle Company will host their annual Angus/Hereford Bull Sale (See flyer below) |

| 19 |

Community Bingo at Country Place Senior Living – 820 S. Horton, 2-4pm

Residents and the public are invited the 3rd Tuesday of each month for Community Bingo |

| 19 |

Zumba Classes at FSCC Ellis Fine Arts Center, 2108 S. Horton

Zumba classes are held every Tuesday & Thursday night from 5-6:15pm. $3 per class

Contact Kassie Fugate-Cate: 620-223-2700 for more info |

| 19 |

City Commission Meeting – City Hall, 123 S. Main St., 6-7pm |

| 20 |

Rotary Meeting – Presbyterian Church,

308 S. Crawford St., 12-1pm |

| 20 |

Adult Coloring Program – Fort Scott Public Library, 201 S. National Ave., 2-4pm

Join us in the library events room for a relaxing afternoon of coloring and conversation. Library provides coloring pages, pens and pencils, and snacks. Bring your own beverage of choice (no alcohol, please)

|

| 20 |

TAG (Teen Advisory Group) – Fort Scott Public Library, 201 S. National Ave., 4-5pm

Exclusively for middle and high school students. We have meetings weekly, including a games & snack night, a community service project, a book club meeting, and a craft night each month

Make a difference in your community while having fun at TAG! Each meeting includes food, drinks, and a good time with your fellow teens. Bring your friends!

|

| 20 |

Gordman’s Grand Opening and Ribbon Cutting – 2400 S. Main St., 5:30-6:30

Save the date and join us for Gordman’s Grand Opening & Ribbon Cutting Event! The first 100 guests will get a scratch-off card, and one lucky person will reveal a $50 shopping card! (See flyer below for more info) |

| 21 |

Join us for the weekly Chamber Coffee of the Fort Scott Area Chamber of Commerce at 8am. This week’s Chamber Coffee will be hosted by Briggs Auto of Fort Scott

Location: 1901 S. Main St., in the GM south building

|

| 21 |

Pioneer Kiwanis Meeting – FSCC Heritage Room, 12pm-1pm |

| 21 |

Zumba Classes at FSCC Ellis Fine Arts Center, 2108 S. Horton

Zumba classes are held every Tuesday & Thursday night from 5-6:15pm. $3 per class

Contact Kassie Fugate-Cate: 620-223-2700 for more info |

| 21 |

Thursday Card Players – Buck Run Community Center, 735 Scott Ave., 6-9pm. Free weekly event to anyone that wants to play cards, drink coffee, eat snacks, and socialize |

| 21 |

Farm Finances 101- Empress Event Center,

7 N. Main, 6:30pm-8pm

Come learn about financial topics such as: Cash Flow Statements, Balance Sheets, Business Analysis Pages, and more. Presented by Ethan Holly, Ag Lender at Landmark Bank

Dinner included. Please RSVP to Southwind Extension District, Fort Scott Office:

620-223-3720 (See flyer below for more info) |

| 22 |

Weekly Livestock Sale at Fort Scott Livestock Market. Starting at 10am on both Fridays & Saturdays

Fridays: Cows, Pairs, Big Bulls

Saturdays: Stocker & Feeder Cattle, followed by any cows & bulls that come in late Friday & Saturday. Cafe open both sale days. You don’t have to be a buyer, just to come watch the sale and visit the cafe!

|

| 22 |

Lenten Fish Fry hosted by Knights of Columbus – Kennedy Gym behind Mary Queen of Angels Catholic Church, 705 S. Holbrook

Each Friday from March 8th through April 12th. Doors open at 5pm and we serve until 7pm. Menu includes southern fried catfish, baked white fish, spaghetti, green beans, coleslaw, baked potatoes and french fries, grilled cheese for the kids. Free-will donation or $5 for

take-out box |

| 23 |

Next of Kin performing at the Boiler Room Brewhaus – 10 S. National Ave., 7pm-9pm

Next of Kin, Country music band from SE Kansas. Tickets $10.00, available at The Boiler Room Brewhaus, the Chamber and the Visitors Center. Meet the band at the pot luck from 6pm to 7pm |

| 25 |

Creating Art Celebrating Age Contest by Presbyterian Village – 2401 S. Horton

Entry Deadline: March 25th, 2019

Open to all area artists 65 and older, amateur or professional. Non juried exhibitors of all ages are welcome to display their art. Artwork may be dropped off March 18th-25th.

Exhibit: March 26th – April 10th, 2019

9am – 5pm, Presbyterian Village, 2401 S. Horton, Fort Scott (Main Lobby)

Reception: April 5th, 2019

3:30pm, in the Dining Room

(See flyer below for more information) |

| 25 |

Chamber Board Meeting – Papa Don’s, 10 N. Main St., 12pm |

| 26-27 |

Story Time – Fort Scott Public Library, 201 S. National Ave., 10-11am |

| 26 |

T.O.P.S Meeting – Buck Run Community Center,

3-4pm |

| 26 |

Fort Scott Kiwanis Meeting – FSCC Heritage Room, 2108 S. Horton, 12-1pm |

| 26 |

Zumba Classes at FSCC Ellis Fine Arts Center, 2108 S. Horton

Zumba classes are held every Tuesday & Thursday night from 5-6:15pm. $3 per class

Contact Kassie Fugate-Cate: 620-223-2700 for more info |

| 26 |

Author Talk and Book Signing at Hedgehog.INK – 16 S. Main, 6pm

Meet and greet author Joyce Love. There will be an author talk, Q & A and book signing. Her book will be available for purchase in the bookstore. Light refreshments will be served |

| 27 |

Breakfast Bingo at Buck Run Community Center, 2nd and 4th Wednesdays of each month – 735 Scott Ave. – 9am-10am

Come drink some coffee and play some bingo at Buck Run. Staff will provide the bingo cards, the caller, and coffee. Prizes provided by the Fort Scott Recreation Commission |

| 27 |

Rotary Meeting – Presbyterian Church,

308 S. Crawford St., 12-1pm |

| 27 |

Adult Coloring Program – Fort Scott Public Library, 201 S. National Ave., 2-4pm

Join us in the library events room for a relaxing afternoon of coloring and conversation. Library provides coloring pages, pens and pencils, and snacks. Bring your own beverage of choice (no alcohol, please)

|

| 27 |

TAG (Teen Advisory Group) – Fort Scott Public Library, 201 S. National Ave., 4-5pm

Exclusively for middle and high school students. We have meetings weekly, including a games & snack night, a community service project, a book club meeting, and a craft night each month

Make a difference in your community while having fun at TAG! Each meeting includes food, drinks, and a good time with your fellow teens. Bring your friends!

|

| 28 |

Join us for the weekly Chamber Coffee of the Fort Scott Area Chamber of Commerce at 8am. This week’s Chamber Coffee will be hosted by County of Bourbon

Location: 210 S. National (Courthouse)

|

| 28 |

Pioneer Kiwanis Meeting – FSCC Heritage Room, 12pm-1pm |

| 28 |

Zumba Classes at FSCC Ellis Fine Arts Center, 2108 S. Horton

Zumba classes are held every Tuesday & Thursday night from 5-6:15pm. $3 per class

Contact Kassie Fugate-Cate: 620-223-2700 for more info |

| 28 |

Thursday Card Players – Buck Run Community Center, 735 Scott Ave., 6-9pm.

Free weekly event to anyone that wants to play cards, drink coffee, eat snacks, and socialize |

| 28 |

Bourbon County Garden Club Meeting at Hedgehog.INK – 16 S. Main, 6pm |

|

|

Save the Date:

– March 29 – Lenten Fish Fry hosted by Knights of Columbus at Mary Queen of Angels Catholic Church

– March 30 – Gardener’s Auction at Tri-Valley

– April 2 – Job Fair at FSCC Ellis Fine Arts Center

– April 2 – Quarterly Downtown Meet & Greet

Click here for full events listing on our website. |