Kirk Sharp started his duties as the new Gordon Parks Museum Executive Director on Jan. 7.

But Sharp is no stranger to the museum. He has been serving behind the scenes since 2004.

“I always had an interest and encouraged the activities and helped with activities and special events when I could,” Sharp said. He also served on the Gordon Parks Museum Foundation Board for four years.

Sharp is a 1985 graduate of Fort Scott High School, and has worked at FSCC before.

“I worked here in FSCC admissions from 2007 to 2010,” Sharp said. “Then Mercy Hospital where I managed Health For Life, occupational and sports medicine until the hospital closed (In 2018).”

“I feel blessed for this exciting opportunity to be with the Gordon Parks Museum and also being back with FSCC,” Sharp said.

“Kirk was the best choice,” said Kassie Feugate-Cate, FSCC’s Director of Strategic Communication. “He is a great asset to the program. We are grateful and look forward to seeing what he can do with the museum, moving forward.”

The mission of the Gordon Parks Museum is to honor the life and work of Gordon Parks, internationally-known photographer, filmmaker, writer, and musician; and to use his remarkable life story to teach about artistic creativity, cultural awareness, and the role of diversity in our lives.

“I want to continue the mission of the Gordon Parks Museum towards cultural diversity, through special events and programs, not just here in the community, but nationwide,” Sharp said. “Trying to look to the future by becoming more interactive, maybe kiosks or tablets for our digital generation.”

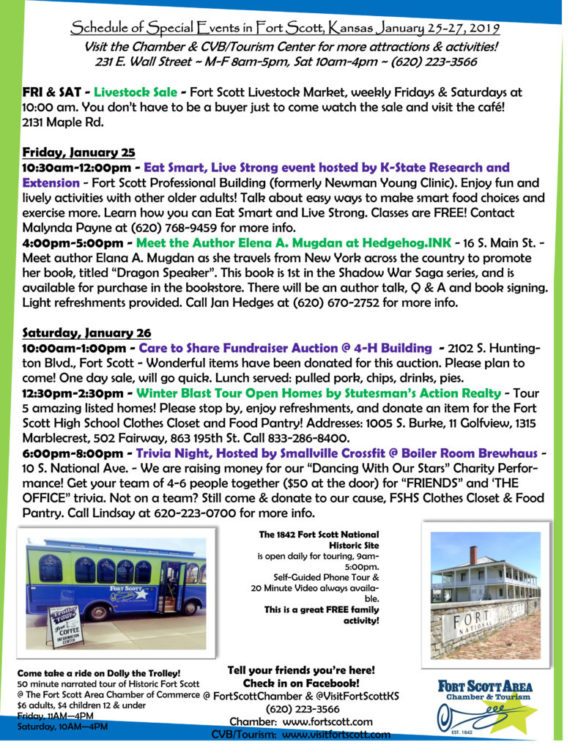

February is designated Black History Month and there will be several learning experiences offered at the museum.

On Feb. 15, there will be a presentation of “Slave to Soldier” during a “Lunch and Learn” at the museum, from 11 a.m. to noon. The public is invited to bring a lunch and hear the history lesson.

This is a Buffalo Soldier history presentation, featuring the Alexander/Madison Chapter-Greater Kansas City/Leavenworth Area, 9th and 10th Cavalry Association. These many generations of negro soldiers served their county from 1866 to 1944 in the military.

“We are also going to show a Kevin Willmott film, “The Jayhawkers” in the month of February. Kansas University Professor Willmott is a past recipient of a Gordon Parks Award and this year is in the running for an Oscar for his film “BlacKkKlansMan.”

History of the museum:

“After Gordon Parks attended the first ever Gordon Parks Celebration in 2004, he gifted the Gordon Parks Center with 30 of his photographs. This spectacular group includes many of his iconic works such as American Gothic, Tuskegee Airmen, Flavio, Ali Sweating, Ingrid Bergman on Stromboli and many others,” according to the Visit Fort Scott website: https://visitfortscott.com/see-and-do/gordon-parks-museum/

“In 2006, after his death, his personal effects and other memorabilia, per Gordon’s wishes, were given to the Museum. This valuable collection included many of his awards and medals, personal photos, paintings and drawings of Gordon, plaques, certificates, diplomas and honorary doctorates, selected books and articles, clothing, record player, tennis racquet, magazine articles, his collection of Life magazines and much more,” according to the Vist Fort Scott website.

The museum is open from 8 a.m. to 5 p.m. Monday through Friday.

For more information see The Gordon Parks Museum Facebook page.

Sharp is married to Sis Sharp and has two children, Jolee, 26 and Trey, 24.