The following was submitted by USD234 regarding the mill levy.

USD 234 Shares Update on Mill Levy

Fort Scott USD 234 would like to share the answers to questions that have recently arisen about the district’s mill levy and property taxes.

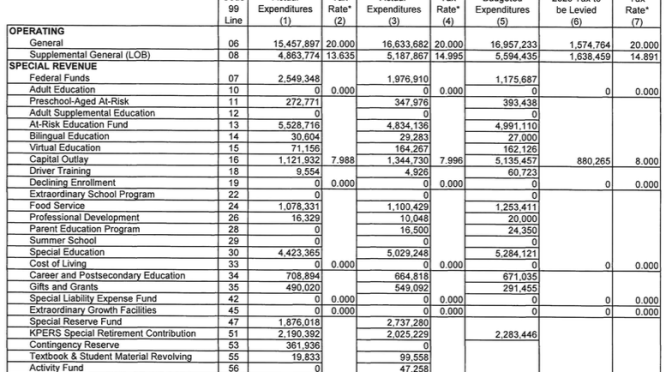

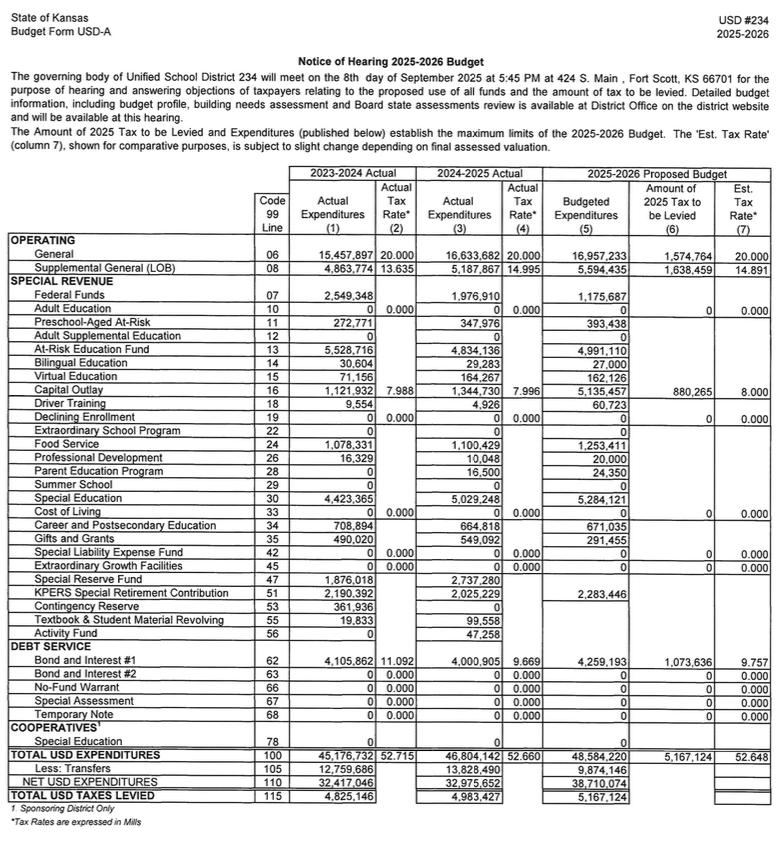

First, it’s important to understand how the budget process works. The Board of Education meets with the district administrators in the spring as we begin the process of building the budget. The Board provides the administration direction as to how they want the budget prepared after reviewing the needs of the district and input from the administration. Typically, the Board directs us to keep the tax rate flat or to reduce or be lower than the previous year. The administration then works on the budget preparation through the months of June and July in partnership with the Bourbon County Clerk and Appraiser, who sets assessed property valuations we use to build the budget. We present a draft of the budget to the Board of Education for feedback in August with the final presentation and budget hearing in September.

Another common question is about the Recreation Commission and Buck Run Community Center. The Recreation Commission is a separate entity from the USD 234 school district. They operate under their own board, budget, set their tax rate, and have their own budget hearing independent from the school district.

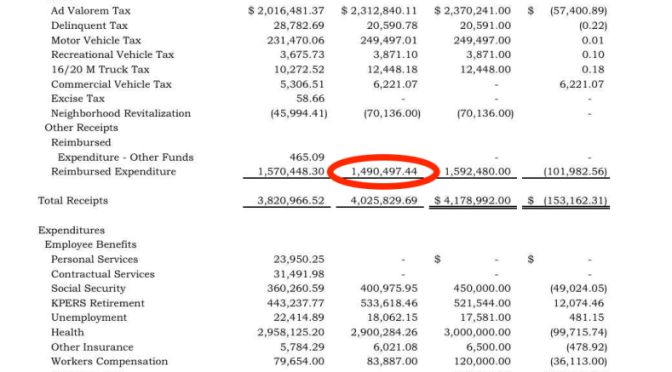

What’s Happening with USD 234’s Mill Levy?

Good news! The district’s tax rate will actually be slightly lower this year. Here’s a look at the numbers:

| Fund | 2024-25 Actual | 2025-26 Proposed | Difference |

| General | 20.000 | 20.000 | 0.000 |

| Supplemental General | 14.895 | 14.891 | -0.104 |

| Capital Outlay | 7.896 | 8.000 | +0.004 |

| Bond & Interest | 9.669 | 9.757 | +0.088 |

| Total | 52.660 | 52.648 | -0.012 |

Even though USD 234 will technically “exceed revenue neutral” because of rising property valuations in the county and State aid, the actual tax rate is going down slightly. Over the last 10 years, the district tax rate has remained stable, dropping just over 1 mill during that time period.

Why does the district choose not to be Revenue Neutral?

Each year, the Kansas Department of Education determines the percentage of state aid the district will receive based on the poverty level in the district. That number changes yearly. This year, we will receive between 65% and 69% of our funding for the supplemental general, bond and interest, and capital outlay funds from the State. That leaves only 31% to 35% of those budget totals to be funded locally. Our state aid percentage has gone up each year, which brings additional dollars into the district from other parts of the State. This was part of the equalization lawsuit that went through the courts years ago.

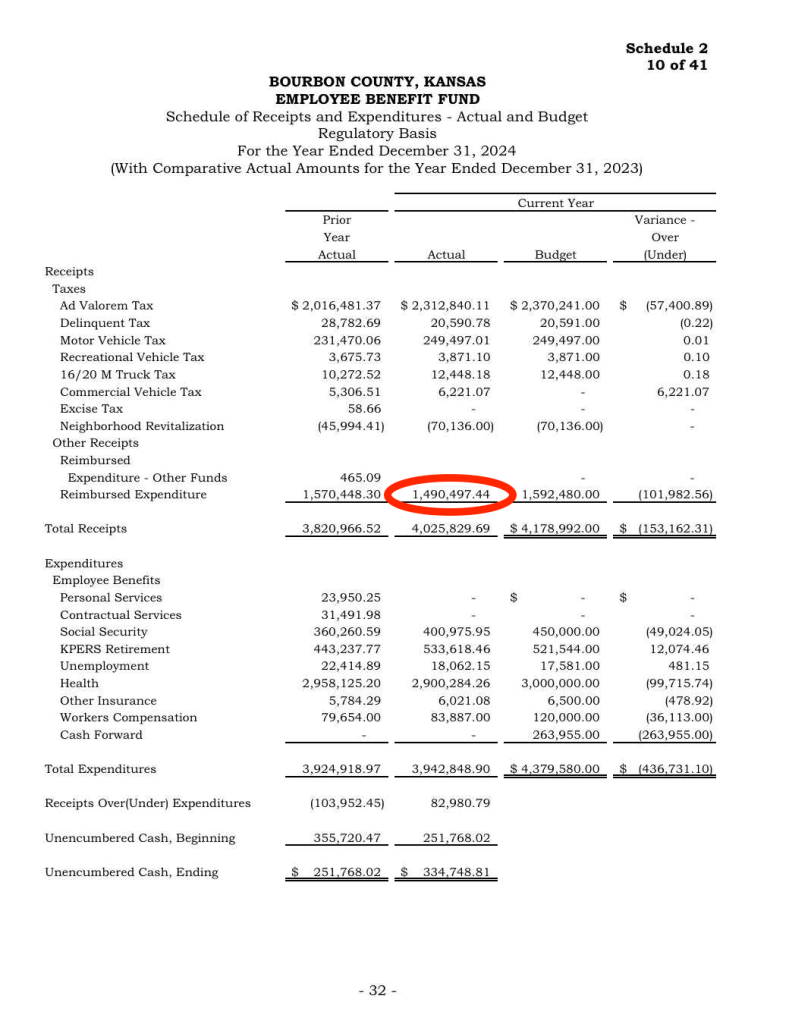

Why was there a discrepancy between what the County sent to taxpayers and the actual budget being published by the district?

Some of the confusion comes from the Notice of Proposed Property Tax report that Bourbon County recently mailed to taxpayers. Those numbers were based on early estimates and don’t always match what the district actually adopts. We are required to provide the County Clerk with our estimates very early in the budget building process, creating a discrepancy between the proposed and the actual budget numbers.

Here’s how the county’s estimates compared with USD 234’s proposed levy:

| Fund | County Estimate | USD 234 Proposed | Difference |

| General | 20.000 | 20.000 | 0.000 |

| Supplemental General | 17.001 | 14.891 | -2.110 |

| Capital Outlay | 8.000 | 8.000 | 0.000 |

| Bond & Interest | 9.757 | 9.757 | 0.000 |

| Total | 54.758 | 52.648 | -2.110 |

As can be seen, the original estimates were a little higher than what USD 234 is actually proposing to the Board of Education.

Clearing Up Misinformation

The District appreciates the taxpayers and the funding they provide for our students’ education. Because of the funding provided to the district, the District is able to provide high quality teachers, staff, and resources to prepare every student with the skills and knowledge needed to be successful beyond high school. The district welcomes any questions you may have about our budget or anything else concerning the school district. Should you have any questions, please contact:

- Superintendent Destry Brown at (620) 223-0800 or [email protected]

- Assistant Superintendent Terry Mayfield at (620) 223-0800 or [email protected]

- Assistant superintendent Dr. Zach Johnson at (620) 223-0800 or [email protected]