8:53 am

Terry Sercer is on the agenda for this mornings commission meeting at 9:00. There are already 8 people in attendance.

9:00 am

As the clock chimes indicating the top of the hour, everyone stands and begins the meeting with the pledge to the American flag.

Chairman Endicott introduced Terry Sercer as an accredited auditor.

Terry said he was asked to:

- Verify the proper publication of taxes.

- Summarize delinquent taxes

- Verify the process for tax sales.

- Verify whether proper interest charges are being applied.

Mr. Sercer said that the proper publication of taxes didn’t occur. On tax payer who was on the plan was actually published. Some people who were not published, didn’t have plans on file. The manual list of the payment plan omitted seven taxpayers and didn’t show some of the previous years taxes.

9:03 am

Mr. Sercer did not spend time looking at previous years tax sales. He said he was told by the Treasurer that the previous tax sale included people who had been on the payment plan.

9:05 am

The accounting for partial payments involves putting money into a fund and then when the amount is sufficient, applying it to the amount owed. There were two systems in use because the new system couldn’t handle partial payments.

9:07 am

Mr. Sercer was able to obtain copies of every payment plan. He went through every one to make sure the proper interest rate was supplied. He then traced all the partial payments to the records on the old system. He also verified the proper payment of interest.

9:08 am

Mr. Sercer said that he didn’t think people knew about the partial payment plan and there didn’t seem to be any type of written eligibility requirements, but noted that state law allows the Treasurer to use his/her own judgement.

He said that the Treasurer and several relatives were repeat users of the plan. Also there were several personal property taxes that were on the plan. Mr. Sercer said he wasn’t aware of a statute that allows payment plans on personal property. The Treasurer said she checked with Johnson county before doing this.

Mr. Sercer pointed out several examples where plans were for very small amounts that wouldn’t have allowed the individuals to pay off the amounts owed within 3 years. He referred to these as “errors in judgement.”

9:13 am

There were numerous errors in the manner in which partial payment plans were established. Mr. Sercer said that the amortization on 23 of 224 payment plans that are now in plance “made no sense whatsoever.” The Treasurer wasn’t sure how these had been calculated. He said he couldn’t audit the history to see if it had been changed from what the computer calculated. There was not correlation between the plans that had the expected interest and the ones that had “crazy” interest.

18 of the agreements used the right tax, but the interest rate was far to low. In some cases the interest rate was 0%. 27 agreements had a higher interest rate than they should have. 8 plans looked reasonable, but there wasn’t a schedule to verify them. About 1/3 had interest rate issues.

9:17 am

The computer system from Infinitec that was calculating interest was no longer under maintenance, so that might have been part of the reason some interest rates were incorrect. These errors are in addition to the ones mentioned above.

9:19 am

The way that the interest and tax were applied was incorrect. Sometimes early payments were applied entirely to interest. He said this was a flaw in the program itself.

Mr. Sercer said there were also errors in the way it was managed and implemented. Some tax payers did not make their payments on time. Late payments should require recalculating the interest. The actual payment plan states that it is estimated amount and that late payments may require additional interest to be paid.

9:21 am

Most people on the payment plan did not pay the amount they should have. One tax payer under paid by $5,000. The Treasurer’s own tax payments were low, but she paid to catch up and now has overpaid.

A number of tax payers overpaid interest by approximately $800. (It sounds like this is cumulative–not per tax payer.)

There was a case where the Treasurer wrote off interest based on a judgement call in hopes of recovering some taxes before the property went to sale. Mr. Sercer said he was told that was the only case where that occurred.

9:26 am

88% of the plans currently in place are not making payments as agreed–and that is even given them some leeway for time. Mr. Sercer said that the payments that are not being paid can probably be terminated.

It is the auditor’s understanding that property on a payment plan still needs to be sold. He suggest that all the money in the payment plan fund should be applied to taxes and move forward on the new system that is calculating interest correctly.

9:29 am

Mr. Sercer said there needs to be better controls in place so amounts can’t be over-ridden without the approval of a second person–preferably from a different office.

9:32 am

Susan Porter (former Treasury employee) said that some of the properties were held off the tax sale and not even sent to the abstractor. She said there was an individual who were held off tax sale for two years and only made one payment of $100. She said they took the money out of the account and applied it to someone else’s account.

She said she knows of three that were held of the tax sale for “personal reason’s of Susan [Quick].”

Mr. Sercer said he did not go back and verify old sales, but agrees that the presence of a payment plan should not change whether or not property is sold.

9:37 am

Susan Porter said that she was repeatedly told to “make it work” in cases where she was told to drop off interest that was owed. She said that the interest that was being calculated was correct, but they were being told to manually change the interest.

She said the case where the interest was completely dropped (which Mr. Sercer mentioned above) was dropped at the request of a realtor who said they could sell the property if the interest was not being charged.

9:41 am

Cecilia Kramer brought and example to ask Mr. Sercer about. He was familiar with that case and said the calculation was wrong because it was based on the old system. Asked some questions about the listing she had originally been given and Mr. Sercer said that some of the numbers on it were incorrect.

Mr. Sercer said the he suspects that if 2011 is wrong, previous years are as well.

9:45 am

One citizen said that he wasn’t sure if he would pay his taxes next year until this is all sorted out.

There was some discussion about how the computer should work in letting people override interest amounts. Mr. Sercer suggested that if a system is put into place where override authority must require more than one person. His example was the treasurer and someone from the clerk’s department.

10:00 am

Chairman Endicott asked about Mr. Sercer’s meeting with the Attorney General and KBI. He said they said they would take his report under advisement. He said that the Treasurer could be removed based on failure to perform their duties. Mr. Sercer said that the Commissioner’s would have to ask the County Attorney to see if the findings are grounds for removal of the Treasurer. The County Attorney would contact the Attorney General and they would start the process if there were grounds for removal.

Mr. Sercer said Attorney General isn’t going to automatically pursue removing someone based on the report he presented to them.

Mr. Sercer said he did not audit whether or not properties were left off of tax sales.

10:14 am

Mr. Sercer was asked if he recommended dumping the old software. He said his understanding was that once the payment plans were done away with and no longer being run, the Treasurer planned to go to the new system and not keep the old one.

The Attorney General said because there are no qualifications for becoming County Treasurer so the AG office looks into several issues in one of the 105 counties each year related to issues like this.

10:18 am

Susan Porter asked if the properties that weren’t previously advertised in the newspaper could actually be sold. She asked if delinquent properties had three years from the first year they were published.

Chairman Endicott said that Mr. Meara “is reviewing that hopefully at this moment.” He also said that most of the properties send to the abstractor were published as they should have been in the past.

10:20 am

Susan Porter said that as an employee of the Treasurer’s department, they told people on the payment plan were allowed to skip a month, pay late or bring in a lump sum.

Mr. Sercer said the county was out about $5000 in the eight months he audited.

10:23 am

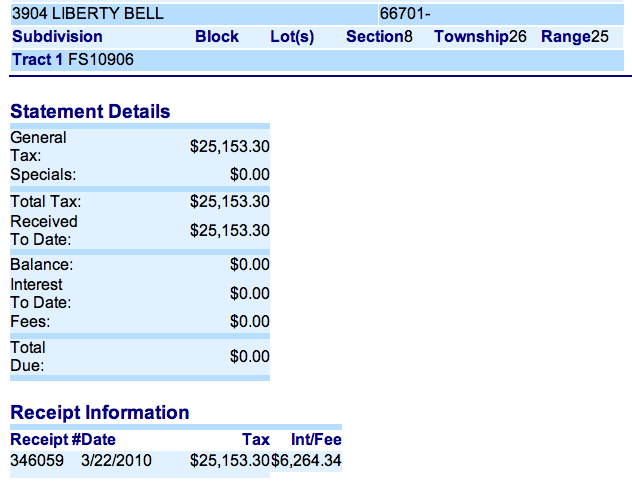

Mr. Sercer and the Commissioners were asked if the people who underpaid their taxes could still be collected from and if people who overpaid would get a refund. The Commissioners didn’t know, but Mr. Sercer said in the case of the person who underpaid by $5,000 they had a statement from the county that specifically said their taxes had been paid for at least the past 2 years.

He said that as far as he knows the fact that this person saved $5,000 on their taxes was not a relative of someone in the Treasurer’s department.

10:29 am

Melvin Antrim asked what the process would be if an elected official was removed from office. The answer is that their party would make a recommendation to the Governor and the Governor would appoint someone.

Randy Handly suggested that the Commissioner’s contact the state representative to see about rewriting the laws in order to change legislation to give less authority to the Treasurer. He felt that the laws need to be changed.

10:39 am

Most people left after the discussion turned to other matters.

The county is looking at buying a fuel truck to fill the generators at the rock quarry. Commissioner Warren, made a motion to purchase a 1979 GMC fuel truck from Mike Judy for $5,000. It will be paid for in January and picked up at that time. The motion passed.

11:00 am

Stewart Porter who is the engineer for the sewer district project out at the lake came in to bring the commission up to speed on a few items. The lift station will be ready to go in a few days, but they don’t have a date for when they will turn it on.

He wondered if the commission had given any thought to the grinder pump at the old Wally Anthony property. He didn’t think it needs to come out, but wondered if the Commissioners felt it need to be moved because of flooding.

Commissioner Warren said that in 1986 he lived near there and in 1986 the water got 12 inches above his dock. He suggested that Mr. Porter measure off the top of the dock to see if the pump was high enough.

The engineers said that the placement of that grinder unit was determined by the easements that they had to work with. The easement was created by condemning part of the lot and the engineers were trying to not condemn a strip through the center of someone’s lot.

Lake Fort Scott isn’t mapped for 100 year flood elevations, so the engineers haven’t had a good guide to work off of. The engineers said it would probably cost something like $1,000 to move it, but it would greatly depend on where they want to put it.

They will compare the elevation to Commissioner Warren’s old dock and come back with additional data.

Stewart Porter asked what should be done with old holding tanks. The original idea was to collapse them, but some of the locations are difficult to get to and may need to just be filled with sand. His goal is to minimize destroying people’s driveways and other property.

Chairman Endicott questioned whose responsibility it would be if a holding tank caved in because it wasn’t collapsed like the others. It sounds like the holding tank still belongs to the homeowner and the agreement was to render the tanks inoperable so the actual method doesn’t matter.

Some individuals do not want the holding tank to be demolished, but it wasn’t clear why.

The Commissioners agreed that filling them with sand was sufficient to destroy them. There was some discussion about the tanks that were above ground where demolishing the tank might leave a pile of rubble and the homeowner might prefer to have the tank left as it is and simply filled with sand.

The engineers said that communication with homeowners has been difficult. There are still a handful of homeowner where they still have no contact information. The County Attorney said she may be able to help contact these individuals.

The bulk of the equipment should be operable within the next month, but actual date will depend on the how much cooperation they get from homeowners. The engineers felt that it would likely be somewhere in the 4 to 6 range.

At that point, the commissioners will need to hold a public hearing to set the rates that people will be charged once the costs are known. Some people may start pumping (and not being charged) before that point.