Monthly Archives: August 2025

County Commissioners to Attend Republican Meeting This Evening

There may be two or more Bourbon County Commissioners attending the Republican Party meeting tonight at 6:00 p.m., located at Uniontown City Hall.

No county business will be conducted.

submitted by:

Selena Williams

Deputy Clerk

The Bourbon County Sheriff’s Office Daily Reports August 28

KS Dept. of Commerce Awarded Economic Development Award

|

U.S. Congressman Derek Schmidt’s Newsletter

|

|

Labors and Leisure on the Frontier: Labor Day Weekend at Fort Scott

Saturday, August 30, Fort Scott National Historic Site will take you on an exploration of the labors and leisure on an 1840s frontier post. Throughout Saturday, enjoy historic yard games, a variety of living history demonstrations, and interpretive programs as you explore the labors and leisure on the fort.

Visit with an officer’s wife doing needlepoint, a laundress making soap and doing laundry, a cooking demonstration, a contracted teamster discussing the best way to assemble his freight wagon and learn about caring for your horse from a Dragoon soldier. Guided Fort Tours will be offered daily at 10 a.m. and 1 p.m. All programs are free and open to the public.

Fort Scott National Historic Site’s, a unit of the National Park Service, exhibit areas and visitor center are open Friday through Thursday from 8:30 a.m. – 4:30 p.m. The park grounds are open daily from a half hour before sunrise until a half hour after sunset. To find out more or become involved in activities at the Fort, please contact the park at 620-223-0310 or visit our website at www.nps.gov/fosc.

-NPS-

NPS Photos

The Bourbon County Sheriff’s Office Daily Reports August 27

Southern Baptist CRAFT FAIR! September 12

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

August 25 Bourbon County Meeting Stronghold Discussion

County Commissioner Samuel Tran asked Chris Martin from Linn County to speak about the new radio system choices the county has and what’s associated with changing over to a new system. Martin has been with Linn County since 2009, starting as a sheriff’s deputy, he became IT director in 2015 and has managed the sheriff’s office radios since 2013 and the whole county’s radios since 2015.

He said that Linn is smaller than Bourbon County but has similar terrain to deal with when choosing a radio system. He pointed out that there is a big difference between frequencies and technologies and all digital modes have issues. Bourbon County is currently on a DMR system with two channels on one frequency.

Sheriff Bill Martin said that the current plan is to hire TUSA Consulting Services to do a study and make recommendations for a radio system to a collection of first responder leaders in Bourbon County. TUSA will then collect bids for equipment and services that meet their recommendations for Bourbon County.

One reason for the change over to a new system, in addition to fixing the issues with the current system is that the county must begin working towards encryption per new FBI regulations.

Stronghold Discussion

Stronghold Technologies representatives came to the meeting to discuss the scope of work from their recent assessment of the county’s technology.

Among other issues, they addressed the county’s firewall, the need for new VLANS, cleaning up the user accounts, and organizing the wire and fiber within the county.

The report says that the county’s firewall is a very good one but needs to be reconfigured for best use. The county’s internet system also needs segmentation and dedicated lanes for information transfer. Stronghold would like to install new VLANS, but not new servers at this time, as well as create a plan for replacing hardware as it becomes outdated.

Organizing the wire and fiber by tracing and labeling will reduce the time taken to troubleshoot when issues arise. The goal is to create documentation and a complete map of the Bourbon County network, laying the foundation for their infrastructure.

Another goal in their scope of work is to eliminate the congestion in communicating with the Sheriff’s department.

They also proposed checking the current phone system for correct configuration.

Bourbon County Revenue Neutral Rate Public Hearing Aug. 25

The Bourbon County Commission August 25 meeting began with a public hearing regarding the county’s decision not to remain revenue neutral in the 2026 budget.

The public comment section of the hearing began with Angie Kimmer, a Fort Scott resident since 1998, when her property taxes were about $1300. In 2025 they will pay about $5,200.

“It’s a huge increase…if my husband didn’t work outside of the community we wouldn’t be able to afford our home,” she told the commission. “The solution can’t be to just raise the mill levy.”

“You’re going to tax people out of your community,” she said, comparing property taxes in Fort Scott to those in Navada. “I don’t know why anyone would choose to live here.”

She acknowledged that change within the county is needed, but expressed concern about trying to get money that isn’t there through higher taxes

Mr. Kimmer also spoke, saying that the block they live on has improved, but they haven’t made major improvements to account for the jump in valuation.

“I want to make my house just as pleasant looking as anybody else, but raising property taxes isn’t going to help,” said Debbie Buckley, who moved to Fort Scott last year. She expressed the desire to improve her home, but questioned the affordability of such a decision in light of increasing taxes due to higher property valuations.

Jim Hollisy said that everyone’s property values went up last year, and the county gave raises. He said they need to consider lowering the benefits and the amount of money the county gives to entities throughout the county.

“It’s going to get worse,” he said of the shrinking population of Bourbon County, if they don’t change their tactics. He said taxes are also going up elsewhere, but not as much as in Bourbon County.

County Clerk Susan Walker asked to address the misconception about the Revenue Neutral Rate (RNR) statement. She said it sets the maximum levy for all entities, but, “That doesn’t mean that’s where your levies are going to end up.”

She said that the Fort Scott Recreation Commission received a beating on social media because they format their budget document differently than other entities, which made it appear that they would tax at their maximum allowable amount, but they are only increasing by about a half a mill over last year.

The RNR statement limits the highest rate that any taxing entity can go. These entities are not all Bourbon County proper. The county doesn’t control everybody’s budget.

Bourbon County Counselor Bob Johnson said the county tax on a particular piece of property is only 30% of the total property tax collected. The rest is the state, community college, and other entities.

Walker also said that sending the statements costs the county $12,000 in addition to the cost of publishing it in the paper. This time the cost is reimbursed by the state, but that may not always be the case. She suggested voters reach out to their legislators about doubling up on the work and cost as the state has required.

Joyce Flanner, a 50 year resident of Bourbon County, said that because of the increase in taxes and valuation on a home she paid off years ago, she has had to postpone her retirement to be able to pay her tax bill. That bill has gone from $1800 eight years ago to $3400 this year. She acknowledged that the county is not responsible for all of it.

After Flanner, no further citizens chose to speak and the hearing was closed. Then the commissioners gave their comments.

Commissioner Samuel Tran said he has spent weeks analyzing the increased cost of housing and identifies with those who spoke. He is a four-year resident of Bourbon County, and his taxes have gone up each year.

“This is not a Bourbon County issue. This is an issue with our nation,” he said. People are being priced out of their homes and the ability to retire.

He said that if the county doesn’t increase taxes, services will be cut. “We need to lobby our legislators,” he said.

“I need to figure out how to fix this or at least soften the blow,” he said. “Hopefully, what we do here tonight will help out the vast majority of the people in the county. I promise you it will not help out all of you,” but he needs to take care of the majority.

Commissioner Mika Milburn reiterated that not going revenue neutral does not mean the commission is raising the mill, it means they aren’t lowering the mill to adjust for the increase in valuation of properties. That increase in revenue is going to go toward an increase in employee benefits and insurance costs as well as other costs beyond the county’s control.

She doesn’t want to increase the mill but let the valuations compensate for the costs.

Commissioner David Beerbower had high hopes of lowering the mill when he ran for office, and of making Bourbon County a lower property tax county.

Since taking office, two commissioners have resigned and there’s been a great deal of turnover in the county’s departments.

They are now trying to make up for previous year’s high spending which has caused the county’s cash reserves to be depleted.

“We need a strategic plan, and we needed it yesterday,” he said. We can’t continue with the same old, same old.

You either raise taxes or cut services, he said. It may be in 2027 that we have to look at cutting services.

Milburn thanked the City of Fort Scott for working with the county on 911 services, because if not for that, “we would be raising the mill, for certain.” She also said that they would continue to work to reduce the budget and encouraged the audience to keep coming to hearings and meetings and telling the commission not to increase the mill.

“If things go the way I hope they go tonight, I am going to push the five of us to come up with a strategic plan,” said Tran of the future County Commission. He said they owe the people of this county that plan. Taxes will go up, but the citizens need to have faith that the money will be spent beneficially for the county.

He thanked those who worked on the budget, including the City of Fort Scott and elected officials, and the budget advisory committee.

Milburn read the motion to approve to exceed RNR. The resolution does not set the mill, but allows the county to raise the rate.

The commission then set the Budget Hearing for Sept. 15 with the publication date of September 3. They also set a special meeting for Aug. 29 at 4 p.m.

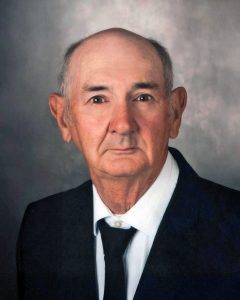

Obituary of Robert L. Russell

Robert Lee (“Bob”) Russell, 89, of Fort Scott, KS, was surrounded by family when he was called home to be with his Savior on August 24, 2025. He was born June 21, 1936 at home in Redfield, KS to Grant Eugene Russell and Echo Mae (Neth) Russell. Bob graduated as valedictorian from Uniontown High School in 1954.

In 1958, he left the family farm where he had worked alongside his father and joined the army. During his time in the service, he trained as a radio repairman in the army signal corps and was stationed in France and Germany. He earned the rank E-5 prior to completing his service and returned home in 1961.

He married his one true love and best friend, Alvena Carol Bloom, on April 22, 1962. During their 60 years of marriage, they reared their three daughters, Laurie, Barbie, and Shelly, with faith and strong family bonds. As a family, they were active in Grace Baptist Tabernacle and undertook many memorable family adventures.

Bob had an impressive and wide-ranging career. After his military service, he was the morning DJ at KMDO radio, where he was an integral part of production in a variety of roles over the years. Because of his considerable mechanical and electronic expertise, he was afforded the opportunity to work as a contractor for NASA at Cape Canaveral, FL during the Space Race of the 60’s. In this capacity, he worked in telemetry on the Apollo missions, including the Apollo 11 moon landing. After returning to Kansas, for a brief time he was the proprietor of Bob’s Fix-it Shop, on East Wall Street, where he repaired small appliances. The Kansas City Power and Light power plant in La Cygne, KS was where he spent the rest of his career as a pneumatic instrument technician. Upon his retirement from KCP&L in 1994, he built their ideal home in the country, just south of Fort Scott.

Bob embraced the role of a faithful steward of God’s creation, and loved all things outdoor – gardening, hunting, fishing, and just appreciating the beauty around him. He was an expert woodworker and craftsman and was committed to preserving traditional practices and ways of life. Bluegrass music was a particularly enjoyable pastime, and he was a regular at bluegrass festivals and performances.

He was preceded in death by his wife of 60 years, Alvena Carol Russell, his parents, Grant and Echo Russell, and a brother, Gail Russell. He is survived by his daughter, Laurie Ann Center and her husband, Bill of Lolo, MT; his daughter, Barbara Lynn Johnson, of Fort Scott, KS; and his daughter, Dr. Sharon Michelle (Shelly) Allen and her husband, Brett, of Fountain, CO. He is also survived by seven grandchildren, Grant Center and wife, Pearl, of Lolo, MT, Lindsey LaRocque and husband, Brandon, of Missoula, MT, Katie, Kellie, and Keriann Johnson, all of Fort Scott, Kylie Allen, of Fountain, CO, and Zaine Allen and wife, Ash, of Colorado Springs, CO. Other survivors include five great-grandchildren (and another on the way), his brother, Jerry Russell, of Fort Scott, and his sister, Shirley Thompson, of Kechi, KS.

A celebration of life services will be held at 10:00 A.M. Saturday, August 30th at the Cheney Witt Chapel. Private burial will take place in the Centerville Cemetery. Memorials are suggested to the Pioneer Harvest Fiesta and may be left in care of the Cheney Witt Chapel, 201 S. Main, P.O. Box 347, Ft. Scott, KS 66701. Words of remembrance may be submitted to the online guestbook at cheneywitt.com.

Southwest Missouri Hwy. 54 100 Miler Yard Sale Aug. 28-30 Starts in Fort Scott