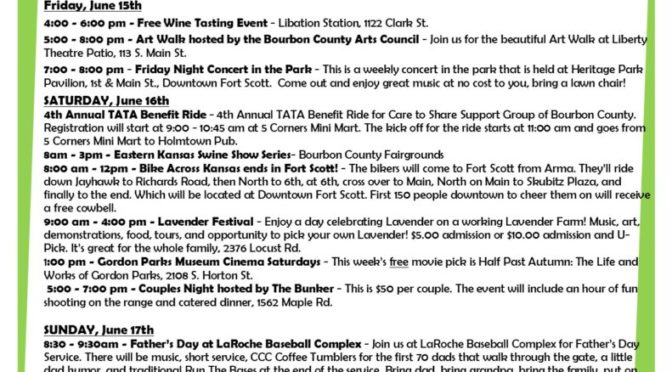

According to Walt Fick, a K-State Research and Extension Range Specialist, Sericea lespedeza has been a statewide noxious weed in Kansas since July 1, 2000. Despite control efforts, this introduced, invasive species continues to persist on rangeland, pasture, and CRP acres in the state. Sericea lespedeza has a tremendous seed bank that helps reestablish stands following control efforts. Sericea lespedeza currently infests nearly 500,000 acres in Kansas.

There are no known biological controls that can be effectively used on sericea lespedeza. However, grazing with sheep and goats can suppress sericea lespedeza stands and produce a saleable product. Cattle supplemented with corn steep liquor (CSL) have been shown to consume more sericea lespedeza than animals not supplemented with CSL. Frequent mowing will reduce sericea lespedeza, but is also damaging to plants that might be growing/competing with sericea. A single mowing in mid- to late-July will eventually reduce stands of sericea lespedeza to some extent but has not eliminated sericea, even after several years of mowing. A late-summer mowing will eliminate most seed production. Application of appropriate herbicides about 4-6 weeks after mowing will help reduce sericea lespedeza stands, but will also damage other forbs. Prescribed burning in April seems to stimulate seed germination. Burning in August and early September nearly eliminates seed production.

Herbicides applied at the correct time and under favorable environmental conditions can significantly reduce sericea lespedeza, but retreatment has proven to be required. Early summer is a good time to consider spraying sericea lespedeza. Plants are in a vegetative growth stage and previous research has indicated good to excellent control at this time.

Remedy Ultra (triclopyr) and PastureGard HL (triclopyr + fluroxypyr) can provide effective control when applied during June and into early July when the sericea plants are in a vegetative growth stage.

Products containing metsulfuron, such as Escort XP, Cimarron Plus, and Chaparral, are generally more effective in the late summer when sericea lespedeza is actively blooming.. Use a non-ionic surfactant with all of these products. These products containing metsulfuron may stunt tall fescue.

For spot applications, mix 0.5 fl oz PastureGard HL per gallon of water, use a 1 percent solution of Remedy Ultra in water or 1 gram Escort XP per gallon of water.

Herbicide treatments will need to be repeated at least every 2 to 4 years to keep this invasive species in check. Initial treatments should reduce dense stands to the point where spot treatment can be used in future years. Left untreated, sericea lespedeza will quickly dominate a site, greatly reducing forage production and species diversity.

If you are unfamiliar with sericea lespedeza, learn how to identify the species and get started with a control program. Be persistent with control efforts to keep this invasive species at manageable populations. Contact Southwind Extension District Agent Christopher Petty at 620-223-3720 or by e-mail at [email protected] for more information.