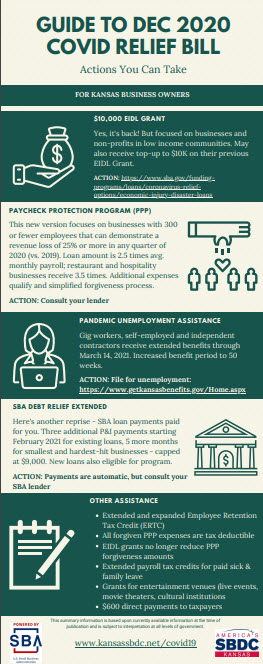

This new version focuses on businesses with 300 or fewer employees that can demonstrate a revenue loss of 25% or more in any quarter of2020 (vs. 2019).

The Loan amount is 2.5 times the average monthly payroll; restaurant and hospitality businesses receive 3.5 times. Additional expenses qualify and simplified the forgiveness process.

PAYCHECK PROTECTION PROGRAM (PPP)

ACTION: Consult your lender

Here’s another reprise – SBA loan payments paid for you. Three additional P&I payments starting February 2021 for existing loans, 5 more months for smallest and hardest-hit businesses – capped at $9,000. New loans also eligible for the program.

SBA DEBT RELIEF EXTENDED

ACTION: Payments are automatic, but consult your SBA lender

GUIDE TO DEC 2020COVID RELIEF BILL

Actions You Can Take

Gig workers, self-employed and independent contractors receive extended benefits through march 14, 2021. Increased benefit period to 50 weeks.

PANDEMIC UNEMPLOYMENT ASSISTANCE

ACTION: File for unemployment:

https://www.getkansasbenefits.gov/Home.aspx

Yes, it’s back! But focused on businesses and non-profits in low-income communities. May also receive top-up to $10K on their previous EIDL Grant.

$10,000 EIDL GRANT

ACTION: https://www.sba.gov/funding-programs/loans/coronavirus-relief-options/economic-injury-disaster-loans

Extended and expanded Employee RetentionTax Credit (ERTC)

All forgiven PPP expenses are tax-deductible

EIDL grants no longer reduce PPP forgiveness amounts

Extended payroll tax credits for paid sick &family leave

Grants for entertainment venues (live events, movie theaters, cultural institutions

$600 direct payments to taxpayers

OTHER ASSISTANCE

www.kansassbdc.net/covid19

FOR KANSAS BUSINESS OWNERS

This summary information is based upon currently available information at the time of publication and is subject to interpretation at all levels of government.